While dealers might not want to get rid of inventory that could eventually be sold, sometimes it makes sense for dealers to get rid of unsold inventory to make the best use of their dealership lot space. In order to move a unit that’s been sitting on the lot for a while, a dealer could take it to sell at auction.

Click here to learn more on why a dealer might want to get rid of some inventory at an auction.

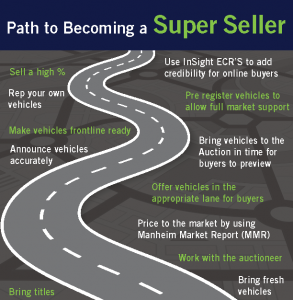

How can dealers successfully sell at auction?

Dealers need to make sure a number of items are in order for a unit to successfully sell at auction.

Dealers need to make sure a number of items are in order for a unit to successfully sell at auction.

Pre-register vehicles a week beforehand

Dealers should pre-register the vehicles they are interested in selling at auction a week beforehand.

Pre-registering vehicles allows for full marketing support. If sale day is on a Wednesday, dealers can’t expect their vehicles to get registered for the sale and fully marketed if they bring units in Tuesday at 5 p.m. The auction needs time to register the vehicles, to put images and information on their website, or on their simulcast or pre-sale reports.

If dealers pre-register their units, it gives other dealers time to preview the vehicles they might be interested in purchasing. Buyers have a limited amount of time to check out a car while it is in an auction lane. Many dealers will often walk the auction lot beforehand and make a list of the cars they are interested in bidding on. If the unit isn’t there when these dealers walk the lot, that vehicle won’t be seen by potential buyers.

Price to the market

Dealers need to be prepared to sell and to not take inventory back. In order for that to happen, dealers need to have reasonable expectations in terms of pricing when they bring vehicles to auction. If a dealer has a unit on the floor for $10,000 and the market value is $8,000, that dealer can’t expect to get $10,000 out of that unit. Reviewing the Manheim Market Report helps dealers find an accurate market value for the vehicle they are trying to sell.

Make sure all units are front line ready

By the time the auction rolls around, dealers need to make sure their units are front line ready, which doesn’t just mean that vehicles are sparkly clean inside and out. To be front line ready, each dealer also need to make sure their units appear in the correct lanes, and have condition reports and titles in order by sale day.

Some auctions have lanes with certain categories attached to them, for example a “new cars” lane or a “$4,995 and under” lane. If any units fit within an auction lane category, dealers need to make sure those units get to the appropriate lanes.

Dealers have to disclose all issues associated with a particular vehicle in order to be represented properly. If those issues aren’t disclosed, dealers take the chance of having the vehicle brought back. Lots of buyers, especially online buyers, won’t buy unless the condition report is with the vehicle. If dealers disclose everything, then they can build their reputation up as a credible seller, especially for online buyers.

Having titles present makes for a smoother overall transaction. If dealers are using a floorplanning company, ask the floorplanning company to send titles for pre-sale.

Represent your own vehicles

Some dealers don’t like to represent their own vehicles. If the auction, or someone else, represents a vehicle for a dealer, they might not necessarily get the highest bid possible. This isn’t always the case, but typically when others represent vehicles for dealers they will sell the unit if they get bids within $500 of a dealer’s asking price. Sometimes there will be a counter offer, but it can get lost in the shuffle because of how fast the auction buying and selling process is. Dealers that represent their own vehicles can make a split second decision on whether or not they want to accept an offer that may not quite meet their asking price.

Work with the auctioneer

Auctioneers can’t read a dealer’s mind. If a dealer is on the block and wants a certain amount of money for a unit, that dealer should give the auctioneer an idea of the price they need for that vehicle. That way the auctioneer has an idea of where to start bids. Unless dealers tell them, auctioneers won’t know how much a dealer needs from a particular vehicle.

Become an Auction Super Seller

Selling at an auction can be a great way to switch up inventory and optimize lot space. Keeping these tips in mind puts dealers in a great position to successfully sell units at auction.

These developments were driven by a few different factors. Namely, federal and state legislation and regulation, dealers and finance companies, technological advances and consumer demand and expectations.

These developments were driven by a few different factors. Namely, federal and state legislation and regulation, dealers and finance companies, technological advances and consumer demand and expectations.

You could do a lot in 90 minutes. You could watch three 30 minute shows, walk six miles, or as a used car dealer, you could create an exceptional customer satisfaction experience during the car buying process at your dealership. A

You could do a lot in 90 minutes. You could watch three 30 minute shows, walk six miles, or as a used car dealer, you could create an exceptional customer satisfaction experience during the car buying process at your dealership. A

Born basically with a cell phone in their hands, Gen Z is made up of true digital natives who have never existed in a world without the internet. This generation was born between 1998 and 2016, and their formative years were influenced by the last breaths of the economic boom of the ‘90s, the Great Recession and the war on terrorism.

Born basically with a cell phone in their hands, Gen Z is made up of true digital natives who have never existed in a world without the internet. This generation was born between 1998 and 2016, and their formative years were influenced by the last breaths of the economic boom of the ‘90s, the Great Recession and the war on terrorism.

Sixty-six percent of recent purchasers say, “YouTube was one of the best places to watch ‘in-action’ videos of vehicles I considered buying.”

Sixty-six percent of recent purchasers say, “YouTube was one of the best places to watch ‘in-action’ videos of vehicles I considered buying.”

NextGear Capital has announced a new agreement with

NextGear Capital has announced a new agreement with

NextGear Capital, Inc., the most comprehensive provider of lending products and solutions for the automotive remarketing industry, is pleased to announce the recent closing of its $1.95 billion securitized bank facility. Led by

NextGear Capital, Inc., the most comprehensive provider of lending products and solutions for the automotive remarketing industry, is pleased to announce the recent closing of its $1.95 billion securitized bank facility. Led by

We connect dealers to thought leaders within our industry through the Cox Automotive Dealer Learning Center, as well as our free quarterly series featuring in-person Dealer Summits and online Webinars. These complementary dealer resources are not only comprehensive, but allow dealers to learn from some of the industry’s leading voices.

We connect dealers to thought leaders within our industry through the Cox Automotive Dealer Learning Center, as well as our free quarterly series featuring in-person Dealer Summits and online Webinars. These complementary dealer resources are not only comprehensive, but allow dealers to learn from some of the industry’s leading voices. Our next webinar titled,

Our next webinar titled,