The key to operating a profitable dealership is finding out how to balance cash flow with current inventory. Figuring out the ideal number of vehicles to put on your lot can be complicated and take quite a bit of time. Luckily, there are several auto floor plan formulas that can help dealers determine how much inventory they should stock and how many sales they should be making monthly.

The key to operating a profitable dealership is finding out how to balance cash flow with current inventory. Figuring out the ideal number of vehicles to put on your lot can be complicated and take quite a bit of time. Luckily, there are several auto floor plan formulas that can help dealers determine how much inventory they should stock and how many sales they should be making monthly.

How many vehicles should you stock?

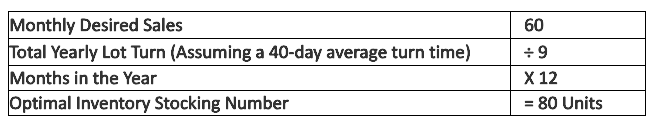

In order to determine the number of vehicles a dealer should stock, they need to have a realistic monthly desired sale goal. This monthly sale goal needs to be realistic because it is one of the key factors in the inventory formula. For example, let’s say a dealer wanted to sell 60 units per month. Assuming the average turn time for vehicles on a dealer’s lot is 40 days, a dealer would turn their lot 9 times over the course of 12 months. The formula is as follows: monthly desired sales divided by how many times a lot is turned per year, multiplied by the number of months in a year.

In this example, a dealer would need to stock 80 units based on 60 desired sales per month and a 40-day average turn time. Adjust the formula with your average turn time to get the most accurate numbers.

How many sales should you make based on stock?

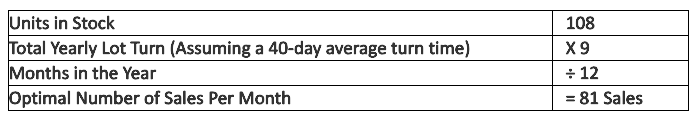

Determining how many sales a dealer should strive for based on the current stock can help a dealer refine their sales per month goal. Knowing the target sales number, you should be working toward based on inventory can also help a dealer avoid over-stocking. Let’s say a dealer has 108 units in stock. Again, let’s assume a turn time of approximately 40 days (nine times per year). To figure out the number of desired sales, multiply the number of units in stock by nine, then divide that sum by 12. Here’s the formula break down:

Based on this example, the dealer should aim to make 81 vehicle sales per month.

Purchase inventory with an auto floor plan

After determining how about how much inventory your lot needs, it’s time to purchase! Dealers have a few options on what type of capital they use to purchase inventory. Some use the cash they have on hand, while some take advantage of an auto floor plan.

There are many great benefits in choosing an auto floor plan instead of cash. One major benefit is that with a floor plan, dealers do not have to convert inventory to cash. If a dealer only uses cash to purchase inventory, a dealer can only get that cash back if they sell the vehicle, either through a consumer or through other channels such as an auction. Selling a vehicle to a consumer for extra cash takes time, and sometimes dealership expenses can’t wait.

With an auto floor plan, if a vehicle hasn’t sold after a contractually determined number of days a dealer only has to pay for a small portion of the car’s value. Once the car sells, the dealer pays back the amount they initially bought the vehicle for.

At NextGear Capital we recommend a dealer’s budget for stocking inventory to be at least a 70/30 mix of their auto floor plan to cash, respectively. Using a floor plan correctly to stock inventory ensures a dealer can buy enough vehicles to meet the needs of their market, and the cash on hand ensures a dealer can pay for their expenses.

If you’re concerned your dealership doesn’t have the right balance of inventory and cash flow, contact us.